By all indications, the economy of south central Minnesota is flourishing. The unemployment rate is down to three percent, earnings are well above traditional distress criteria, and the region has a robust base of jobs in manufacturing, health care, retail trade and educational services. All the traditional measures of a strong economy are present. Now what?

Innovation is a key driver to economic growth. Some economists project that nearly half of the total U.S. Gross Domestic Product (GDP) is tied to advances in innovation. A core value in assessing economies at the macro level – a large scale economy, including all industries, variables, production, and output of a region – is that the more a region creates, refines, and builds upon a product or a service the better and more creative a region gets at it and the more likely it is to market that product or service. Nokia, for example, was a king in the cell phone industry but has found the seas much more treacherous in today’s world of advanced mobile super devices. Innovation does not automatically assume success in business. Marketing, branding and connecting the product to hungry buyers are still the staples to successfully selling a product or service. At a macroeconomic scale, the ability to measure innovation captures insights into the health of an economy now and in the future.

Innovation is a key driver to economic growth. Some economists project that nearly half of the total U.S. Gross Domestic Product (GDP) is tied to advances in innovation. A core value in assessing economies at the macro level – a large scale economy, including all industries, variables, production, and output of a region – is that the more a region creates, refines, and builds upon a product or a service the better and more creative a region gets at it and the more likely it is to market that product or service. Nokia, for example, was a king in the cell phone industry but has found the seas much more treacherous in today’s world of advanced mobile super devices. Innovation does not automatically assume success in business. Marketing, branding and connecting the product to hungry buyers are still the staples to successfully selling a product or service. At a macroeconomic scale, the ability to measure innovation captures insights into the health of an economy now and in the future.

What are the measures of Innovation?

StatsAmerica, a website funded by the Federal Economic Development Administration, produces a composite index as a measure to assess innovation – aptly named the Innovation Index 2.0. It links multiple data sources to create a single measure of innovation for a county, metropolitan area, or state and offers the user the option to run some comparative analysis. The components of the Innovation Index are broken down evenly as follows:

Human Capital & Knowledge Creation: Utilizes educational attainment data, patent creation, university-based knowledge, and business incubators as well as Science, Technology, Engineering and Mathematics (STEM) degrees and employment to determine the extent to which a region’s population and workforce participate in innovative activities.

Business Dynamics: Gauge of competitiveness of a region by analyzing firm (e.g. businesses and employers) entry and exit, including the formation of new businesses, expansions of businesses, venture capital investment flow, investments in high-tech startups, and initial public offerings, among others.

Business Profile: A measure of local business conditions and resources available to entrepreneurs and businesses by indexing foreign direct investment, connectivity to high-speed internet, number of small and large businesses, proprietorship of those businesses, and availability of capital from banks.

Productivity and Employment: Using conventional productivity and employment measures, such as job growth to population ratio, change in share of high-tech industry employment, cluster activities, GDP and patent data, this measure quantifies economic growth, regional “desirability” and direct outcomes of innovative activity.

Economic Well-Being: This category quantifies standard of living as well as other economic outcomes. It utilizes growth in personal income per capita, growth in wages and salaries of workers, proprietor income, poverty rate, income inequality, unemployment rate, net migration, and dependency based on income sources.

These five measures are designed to create a dashboard of innovation inputs (i.e. what is put in, taken in: human capital and knowledge creation, as well as business dynamics and profiles) and outputs (production: such as productivity of a regional economy, employment, jobs created, and economic well-being). These numbers, while independent measures, are all pieces of a greater puzzle that attempts to piece together a complete picture of innovation of a region.

Innovating in Region Nine

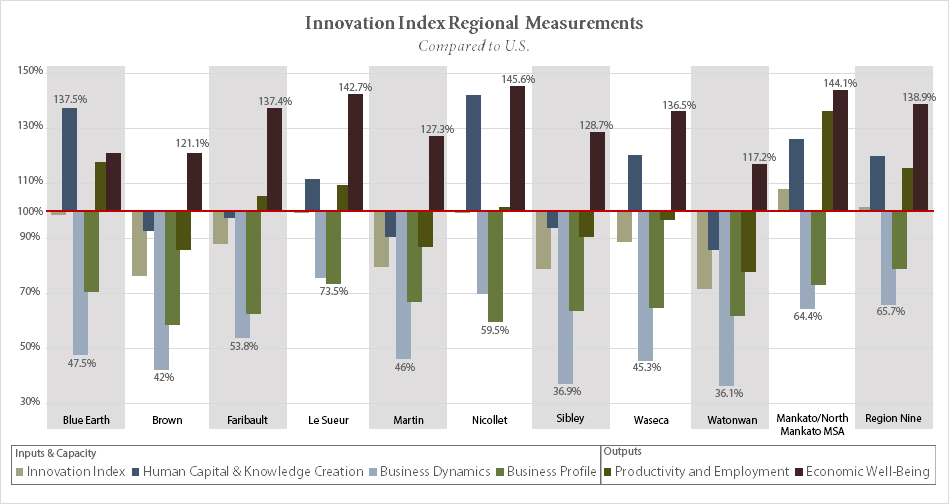

The inputs and outputs of the index are reported as a percentage of the nation. Any number below 100 percent is lower than the national average and any number above 100 percent is above the national average. The four indexes are further defined as input and capacity (human capital, business dynamics and business profile) which comprises 60 percent of the total index and outputs (productivity and employment and economic well-being) comprising the remaining 40 percent.

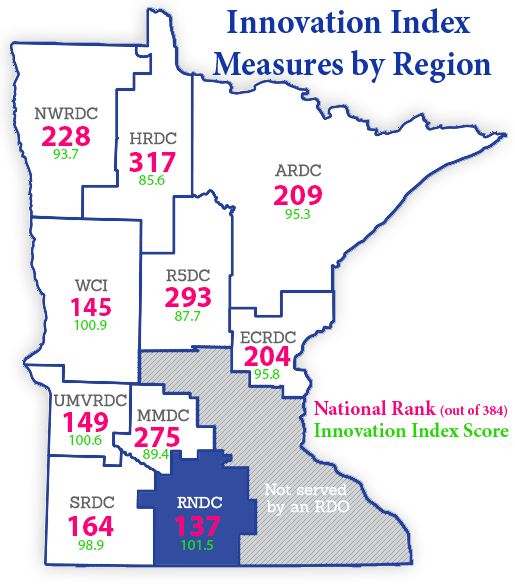

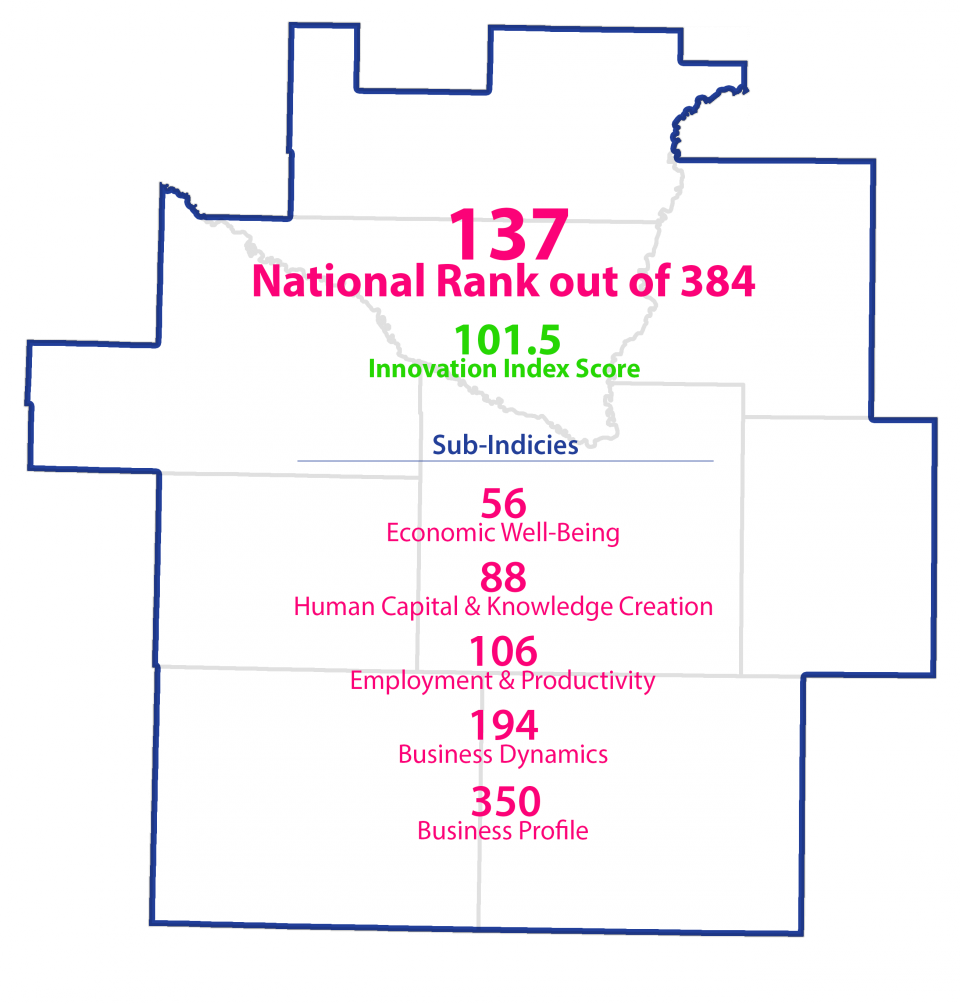

At 101.5 percent, overall innovation in the region is above the national average. As seen in the table above, this index is led by innovation in human capital and knowledge creation, particularly in the Mankato-North Mankato area. For a larger perspective, Economic Development Districts (EDDs), as designated by the U.S. Economic Development Administration to create strategies to plan for economic development on a regional scale are measured. Region Nine ranks 137 out of 384 federally designated EDDs across the nation in the overall composite index and tops all EDDs in Minnesota. For the sub-indices, Region Nine ranks 194th nationally (of 384 EDDs) in business dynamics (3rd among EDDs in Minnesota); 350th nationally in business profile (3rd worst among EDDs in MN ); 56th in economic well-being (3rd in MN); and 106th in employment and productivity (4th in MN); 88th in human capital and knowledge creation (tops in MN). (It should be noted that Upper Minnesota Valley Development Commission; which represents the western Minnesota counties of Big Stone, Chippewa, Lac qui Parle, Swift, and Yellow Medicine; ranks 8th in the nation in the business profile index.)

Drivers of the Index

A key contributor to innovation overall in Region Nine is high educational attainment, particularly in high-school and advanced degree programs. Access to higher education institutions pushes the needle on STEM degrees and jobs in related fields; but that is not the only driver. The region also has a high measure of productivity and employment, particularly in diversification of industries – something that is common in major metropolitan areas, but not always common in larger predominantly rural regions. Region Nine’s key industries have long been: manufacturing, health care, education services, retail, and wholesale trade. These industries not only spur innovation, but are where research and development, production of goods and services, and advanced high-tech degrees are common place and essential to firm survival. Strong innovation in these areas typically translates to strong innovation of the region as a whole.

In Region Nine, the sub-indices themselves tell a compelling story:

Human Capital and Knowledge Creation (Index: 120, National Rank: 88th, State Rank: 1st)

In addition to educational attainment (the indices for high-school attainment and associate degree attainment are among the highest in the nation), Region Nine performs exceptionally in its share of high-tech industry employment, ranking 63rd nationally. The labor force in the high-tech industry includes STEM occupations. Companies like MTU Onsite Energy Corporation (manufacturer of industrial power generation equipment in Mankato), POET Biorefining (a bio-manufacturing plant in Lake Crystal), and Windings Inc in New Ulm are a few examples of companies that are building the STEM workforce in Region Nine.

Business Dynamics (Index: 65.7, National Rank: 194th, State Rank: 3rd)

Region Nine is progressive and excels in creating dynamic traded sector establishments. These establishments serve markets outside of the region. The region also has a strong ratio of business expansions to business contractions – meaning, the region adds more jobs to regional businesses than it lays off. For example, Kraft Foods added an estimated 50 new jobs on a $100-million upgrade to its New Ulm plant in 2016, Verizon Wireless added 160 jobs to its Mankato office in 2014, and Medallion Cabinetry added 30 new jobs in 2014. These expansions produce goods and services that serve customers in the region and outside the region.

Business Profile (Index: 78.8, National Rank: 350th, State Rank: 3rd lowest)

By this measure, Region Nine excels in connectivity of farm operators with internet access. The region falls far below the nation in several key factors that drive the overall index down. These key factors include:

- Small quantity of investment from foreign and national investors

- Lack of residential high-speed internet connections

- Low availability of capital from banks

- Low early life-cycle investments in new small businesses

- Low employment in small businesses

Essentially, the region does not excel in generating support to new start-up businesses from investors overseas. The region has strong exporters, creates innovative products that other areas of the nation want, but falls behind in attracting big spenders from outside the state and nation to help expand their operations.

Employment and Productivity (Index: 115.5, National Rank: 106th, State Rank: 4th)

Most indicators here are above the nation, yet fall in the middle of the pack with the rest of the state. Driven by the monetary value of all goods and services produced (GDP) and diversification of industry concentration, as well as the number and different types of patents produced, the region is set up for export success. Where it falls short is GDP per worker and job growth relative to population growth. There is job growth, but it has steadily slowed over the past decades. A trend that is not just regional, but statewide as well. Consequently, the region also falls short in job growth relative to population growth.

Economic Well-Being (Index: 138.9, National Rank: 56th, State Rank: 3rd)

Low unemployment, low poverty, low income inequality, and higher than average personal income are key drivers here. These are the traditional measures of economic success that the region has excelled at over the past 18 months. Where the region falls somewhat short is net migration, which could be a potential solution to the impending workforce shortage.

Outputs Measure Prosperity

Region Nine is the most innovative in greater Minnesota. It has low unemployment, and a relatively stable and diverse industry mix. With Le Sueur, Nicollet, and Blue Earth counties leading the charge, as well as innovative companies in other counties, Region Nine has a strong outlook for future economic growth. The challenge on the horizon will be how to parlay that potential to address a potential workforce shortage that is projected statewide in the coming decades.